What You Need to Know About Your Labour to Revenue Ratio

Reading Time:

Lead the pack with the latest in strategic L&D every month— straight to your inbox.

SubscribeThe labour to revenue ratio shows how well you utilise labour and resources for business success.

That helps answer questions like, are you using the right talent in the right jobs? Is the cost right? How do you know you’re getting the right return on investment for your overall labour expenses?

In this article, we’ll take a look at the labour to revenue ratio, what it can tell you about your business, how to calculate it, and the best practices to optimise it for your business.

What is labour to revenue ratio?

The labour to revenue ratio is the amount of money an organisation spends on its employees compared to the amount of revenue generated by the workforce. In other words, it’s the return on investment that organisations get from their workers, allowing businesses to see how efficiently they’re operating.

What is inefficiency?

You’re probably wondering what we mean by “efficiently” operating businesses. When it comes to labour to revenue, inefficiency is when businesses use a disproportionate amount of labour resources to generate revenue. We’re talking about excessive or even insufficient labour costs that hold your organisation back from driving revenue to your full potential.

So, inefficiency is essentially poorly optimised labour resources, which can appear in an organisation in several ways:

- Overstaffing. Having more employees than necessary drives up labour expenses. There won’t be enough work for all the staff to do, so productivity will be low, decreasing the amount of revenue each employee generates for the company.

- Poorly utilised resources. This is where labour resources are lacking or allocated ineffectively, hindering (even preventing) productivity and revenue generation.

- Inefficient processes. Outdated or manual processes slow down productivity, revenue generations, and take employees’ time and efforts away from other tasks that they would be able to focus on if those processes were updated or automated and streamlined.

This is why we’ve created the first performance learning management system (PLMS) here at Acorn. At its core, it’s designed to codify and operationalise capabilities to improve organisational efficiency, by offering up the right learning recipe for each person’s betterment (and that of the business as a whole). A PLMS is the only solution that guides learners step-by-step to master the role-specific capabilities that will accelerate organisational performance.

Do you need to measure labour to revenue ratio?

Off the bat, it’s important to remember that this isn’t the same as revenue- or profit per employee, which look at how much revenue or net profit is generated by individual employees, although it does help with understanding labour productivity. Instead, the labour to revenue ratio is about comparing total revenue with the total labour cost.

Measuring labour to revenue ratio gives you information with which to make more informed decisions.

- Highlights efficiencies and inefficiencies: If your labour to revenue cost is high, it could indicate that you’re spending too much of your revenue on labour costs, meaning the workforce costs more than they contribute to the business. On the other hand, a low labour to revenue cost indicates that your employees are already working as effectively and productively as possible.

- Enables benchmarking: A good labour to revenue ratio varies depending on industry, the company’s age, and the company’s size, meaning you can benchmark the performance of your business against similar competitors to get an understanding of how well (or not-so-well) your business is operating.

- Identifies opportunities to reduce costs: If your labour cost percentage is too high for the amount of revenue you gain, it could indicate an area where you can take measures to control costs. Maybe your organisation is overstaffed for what it does and needs to be downsized to optimise efficiency. This will help you reduce costs in recruitment and employee wages, increasing the amount of revenue made in comparison to the cost of labour.

In other words, calculating your labour to revenue ratio is a great way to measure business performance and whether or not your workers are performing efficiently.

However, there are also challenges associated with measuring your employee labour percentage.

- Capturing data: Managing labour costs is hard to do, because the total cost of the workforce isn’t just about the sum of wages paid for hours worked. It also includes indirect labour costs and overhead such as insurance and benefits. So, it can then be hard to get an accurate read on just how much you spend on talent.

- Identifying inefficiencies: Wait, didn’t we just say that the labour to revenue ratio helps in spotting inefficiencies? Yes, but not how you think. While your ratio might indicate that there are inefficiencies present, it doesn’t actually show where they are. For that, you need to use this metric in tandem with others that can pinpoint exactly where things are going wrong.

- Variations in revenue: Revenue isn’t a fixed value, and we don’t just mean that it moves in an (ideally) upward trajectory. Variable costs in supplies, materials or taxes and fees, or even just the time of year all impact revenue. People tend to take time off around holiday seasons, meaning business might slow down over those periods, meaning labour cost percentages vary over that time, too. It’s not necessarily a sign of poor performance or efficiency, but it will affect your labour to revenue ratio.

- Limited insight into business performance: Because good labour to revenue ratios vary between industries as well as company size and age, it can be hard to understand performance based on your labour to revenue alone. This means you need to combine it with other HR and business metrics to get a clearer picture of the many factors might be affecting your labour to revenue ratio.

How to calculate your labour to revenue ratio

To calculate labour costs to revenue, you can use one simple formula: The total cost of labour divided by the total revenue generated over the specified time period.

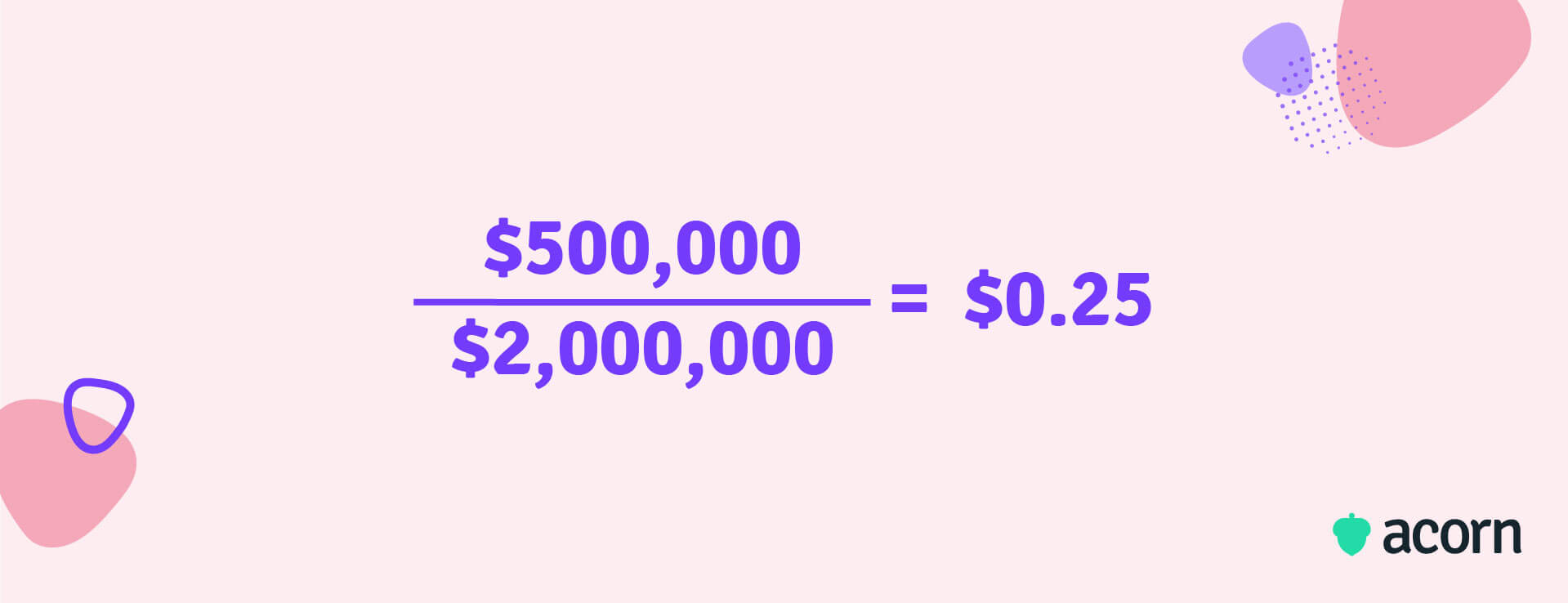

For example, if an organisation has a total labour cost of $500,000 in a year and generates $2,000,000 in that same period, their labour to revenue ratio would look like this:

This would mean that for every dollar generated in revenue, the organisation had spent $0.25 on labour.

As we said before, though, calculating the total cost of labour can be tricky to do. Everything involved in keeping workers employed at your business is a contributing factor to the total cost of labour.

- Employee wages paid (both salaried and hourly wages)

- Employee benefits

- Overtime costs

- Payroll taxes

- Overhead costs (such as insurance)

- Paid leave

- Employee turnover, recruitment, and hiring costs

- Training costs

- Other benefits and incentives.

Best practices for optimising labour to revenue ratio

Optimising your labour to revenue ratio is generally see as an exercise in decreasing labour costs. However, there are ways to enhance the work environment that will optimise your labour percentage in the long-term.

Invest in employee training and development

Not only is this good for your employees’ professional and career development, increasing engagement and morale, but it also builds the necessary capabilities in employees to do their jobs more efficiently, improving productivity and business performance. This isn’t just a one-time thing, either. It’s an important ongoing process to ensure incremental changes in the behaviours of your staff, allowing them to drive organisational transformation for the future. It means that your workforce is supported for the entire employee lifecycle from onboarding to succession, which increases employee retention and lowers the associated turnover costs.

Streamline and automate processes

Technology can help here. Employees can focus their time and skills on more complex tasks when you cut out easily automated processes that would otherwise be time-consuming for your workforce. This allows them to be more productive and generate more revenue for the business.

You can also utilise technology to streamline your training initiatives. This develops employees’ capabilities, allowing them to better perform in their roles and be more productive, increasing revenue.

Build engagement in the workforce

Employees who are more engaged in their work meet better performance outcomes and generate greater revenue for the business. Employee engagement leads to more motivated workers and learners, enabling them not only to perform their roles better, but retain and apply training better. It also means employees enjoy their work and workplace, and will be less likely seek new employment opportunities, lowering turnover costs.

You can improve engagement by:

- Offering development opportunities

- Providing reasonable compensation and benefits

- Taking on and valuing the input of employees in decision-making and day-today operations

- Create a positive work environment and culture

- Provide challenging work.

Improve retention

Recruiting a new hire costs up to $4,000 on average in US companies. That, plus lost productivity in the interim before your new hire is onboarded and brought up to speed impacts your profitability, so you should focus on improving retention to reduce rising labour costs as a result of turnover. There are a few best practice strategies you can use to increase retention among employees.

- Provide training and development. 94% of employees say they would stay with their company longer if the employer invested in their professional development and training.

- Offer competitive compensation and benefits. This reduces the frequency of employees looking to switch jobs for better opportunities.

- Improve onboarding to reduce time to proficiency (and therefore, time to productivity). This increases the quality of employees’ work performance and reduces turnover of new hires.

- Involve employees in decision-making. When employees understand business strategy, vision, and have a say in decisions being made, they feel valued in the company and are more likely to remain in their position.

Regularly monitor and adjust labour costs

Evaluating direct labour costs like employee benefits and compensation as well as your indirect labour costs ensures that you’re operating on a similar level to the rest of the industry.

Perhaps your total cost of labour to revenue is small compared to competitors. That could mean your workforce is incredibly efficient, or it could mean that your employees aren’t receiving a suitable amount of compensation for their work, which can lead to job dissatisfaction and further decreases in productivity. Regularly reviewing your costs in terms of labour allows you to create a healthy environment for the business and its workforce.

Set goals and track key performance

So how do you know if your employees are operating efficiently? You set goals, of course! These will be tangible, measurable goals that will indicate whether employees (and, by extension, the business) are meeting performance expectations. You can use key performance indicators (KPIs) to track performance, which will help you determine whether your labour to revenue costs are sustainable.

Just remember to continuously track performance over time. This way, you’ll be able to see patterns and trends in your business’s labour costs, which can indicate further pain points that need addressing, or a better labour to revenue ratio due to your improvement efforts.

Identify areas of inefficiency

This involves looking at other metrics. Is your turnover rate too high driving up recruitment costs, and is that turnover voluntary or involuntary? These metrics can tell you where the inefficiencies that need to be addressed actually are, allowing you to come up with targeted plans to solve them.

Key takeaways

Labour to revenue ratio is a starting metric, used as a jumping-off point to understand the how efficient your workforce is. When used in tandem with other metrics to identify the underlying causes of productivity, you’ll be able to improve your business and its performance for the future.

By implementing the best practice strategies we’ve talked about, you’ll see an improved labour to revenue ratio in your organisation. That’s strategies including:

- Invest in training and development

- Streamline and automate processes

- Build employee engagement

- Improve retention

- Regularly monitor and adjust labour costs

- Set goals and track performance

- Identify areas of inefficiency.